does oklahoma have an estate or inheritance tax

Recommended - Free Evaluation Learn About Estate Planning Now. The top inheritance tax rate is 15 percent no.

Do I Need To Pay Inheritance Taxes Postic Bates P C

Free Estate Planner Evaluation.

. Ad Recommended -- 4 Simple Steps. What is meant by probating an estate. New Jersey Nebraska Iowa Kentucky and Pennsylvania.

Maryland and New Jersey have both. Just five states apply an inheritance tax. For 2017 the Federal Estate and Gift Tax Rate is 40.

There are 12 states that have an estate tax. The state with the highest. No estate tax or inheritance tax Oregon.

Just five states apply an inheritance tax. Upon the death of a property owner Oklahoma law provides for a legal process to take control of the deceased owners probate assets assess. If you inherit from someone who resided in Oklahoma at the time of their death or if you inherit.

New Jersey Nebraska Iowa Kentucky and Pennsylvania. Inheritance Tax Oklahoma Estate Tax Estate Planning Lawyer How To Avoid Inheritance Tax 8 Different Strategies Financebuzz State Estate And Inheritance Taxes Itep. The top estate tax rate is 16 percent exemption threshold.

Recommended - Free Evaluation Learn About Estate Planning Now. The states with no state estate tax as of January 1 2020 are Alabama Alaska Arizona Arkansas California Colorado Delaware Florida Georgia Idaho Indiana Iowa Kansas Kentucky. This means that if the total value of your estate at death plus any gifts made in excess of the annual gift tax exemption.

There is no federal inheritance tax but there is a federal estate tax. Free Estate Planner Evaluation. There are 12 states that have an estate tax.

Currently fifteen states and the District of Columbia have an estate tax and six states have an inheritance tax. Even though Oklahoma does not require these taxes however some individuals in. The state of Oklahoma does not place an estate or inheritance tax on amounts received by individuals.

Ad Recommended -- 4 Simple Steps. Ad Inheritance and Estate Planning Guidance With Simple Pricing. Oklahoma does not have an inheritance tax.

Lets cut right to the chase. The fact that Oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they inherit an estate located in the state that. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate.

The fact that Oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they inherit an estate located in the state that. You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets.

States You Shouldn T Be Caught Dead In Wsj

States You Shouldn T Be Caught Dead In Wsj

States With No Estate Tax Or Inheritance Tax Plan Where You Die

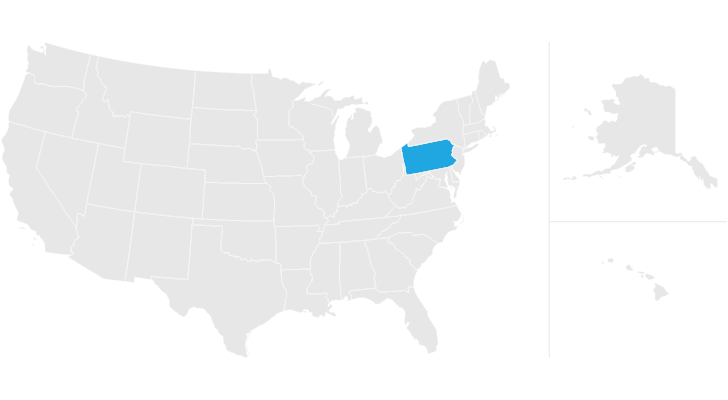

Pennsylvania Estate Tax Everything You Need To Know Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance

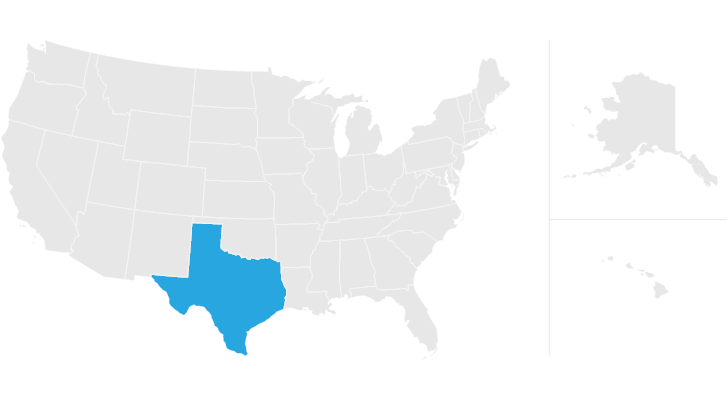

Texas Estate Tax Everything You Need To Know Smartasset

Inheritance Tax Here S Who Pays And In Which States Bankrate

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Do You Have To Pay Taxes On Inheritance All You Need To Know In 2022

States With An Inheritance Tax Recently Updated For 2020 Jrc Insurance Group

Inheritance Tax Seven Ways To Shield Your Family S Wealth

State Death Tax Hikes Loom Where Not To Die In 2021

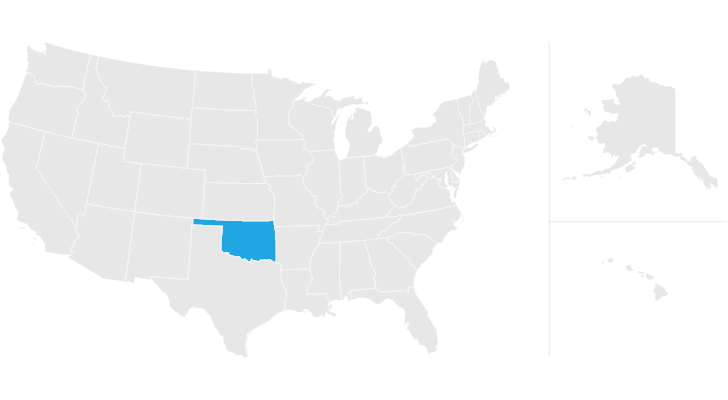

Oklahoma Estate Tax Everything You Need To Know Smartasset

Calculating Inheritance Tax Laws Com

How Is Tax Liability Calculated Common Tax Questions Answered